Calculating Continuation Value in a Ddm

What is the Dividend Discount Model?

The Dividend Discount Model,also known as DDM, is in which stock price is calculated based on the probable dividends that one will pay. They will be discounted at the expected yearly rate. It is a way of valuing a company based on the theory that a stock is worth the discounted sum of all of its future dividend payments. In other words, it is used to evaluate stocks based on the net present value of future dividends.

Table of contents

- What is the Dividend Discount Model?

- Explained in Detail

- Formula

- Dividend Discount Model Example

- Types of Dividend Discount Models

- #1 – Zero-growth Dividend Discount Model

- Zero Growth Dividend Discount Model – Example

- #2 – Constant-Growth Rate DDM Model

- Constant-growth Dividend Discount Model- Example#1

- Constant-growth Dividend Discount Model – Example#2

- #3 – Variable-Growth Rate DDM Model (Multi-stage Dividend Discount Model)

- #3.1 – Two-stage DDM

- Assumptions

- Two-stage DDM model – Example

- # 3.2 – Three stage Dividend Discount Model DDM

- #1 – Zero-growth Dividend Discount Model

- Advantages

- Limitations

- What Next?

- Dividend Discount Model – Foundation Video

- Recommended Articles

Explained in Detail

The financial theory states that the value of a stock is worth all of the future cash flows expected to be generated by the firm discounted by an appropriate risk-adjusted rate. We can use dividends to measure the cash flows returned to the shareholder.

Some examples of regular dividend-paying companies are McDonald's, Procter & Gamble, Kimberly Clark, PepsiCo, 3M, Coca-Cola, Johnson & Johnson, AT&T, Walmart, etc. We can use the dividend discount model to value these companies.

source: ycharts

The stock's intrinsic value is the present value of all the future cash flow generated by the stock. For example, if you buy a stock and never intend to sell this stock (infinite period). What are the future cash flows that you will receive from this stock? Dividends, right?

Here the CF = Dividends.

The dividend discount model prices a stock by adding its future cash flows discounted by the required rate of return that an investor demands for the risk of owning the stock.

However, this situation is theoretical, as investors normally invest in stocks for dividends and capital appreciation.Capital appreciation Capital appreciation refers to an increase in the market value of assets relative to their purchase price over a specified time period. Stocks, land, buildings, fixed assets, and other types of owned property are examples of assets. read more is when you sell the stock at a higher price than you buy. In such a case, there are two cash flows: –

- Future dividend payments

- Future selling price

Find the present values of these cash flows and add them together.

You can download this Dividend Discount Model - Excel Template here – Dividend Discount Model - Excel Template

Formula

Dividend Discount Model = Intrinsic Value = Sum of Present Value of Dividends + Present Value of Stock Sale Price.

This dividend discount model or DDM model price is the stock's intrinsic value.

If the stock pays no dividends, then the expected future cash flow will be the sale price of the stock. Again, let us take an example.

Dividend Discount Model Example

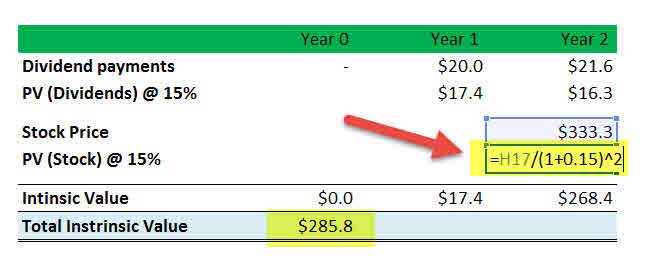

In this dividend discount model example, assume that you are considering the purchase of a stock which will pay dividends of $20 (Dividend 1) next year and $21.6 (Dividend 2) the following year. After receiving the second dividend, you plan on selling the stock for $333.3. What is the intrinsic value of this stock if your required return is 15%?

Solution:

One can solve this dividend discount model example in 3 steps: –

Step 1 – Find the present value of dividends for years 1 and Year 2.

- PV (year 1) = $20/((1.15)^1)

- PV(year 2) = $20/((1.15)^2)

- In this example, they come out to be $17.4 and $16.3, respectively, for 1st and 2nd-year dividends.

Step 2 – Find the present value of the future selling price after two years.

- PV(Selling Price) = $333.3 / (1.15^2)

Step 3 – Add the present value of dividends and the present value of selling price

- $17.4 + $16.3 + $252.0 = $285.8

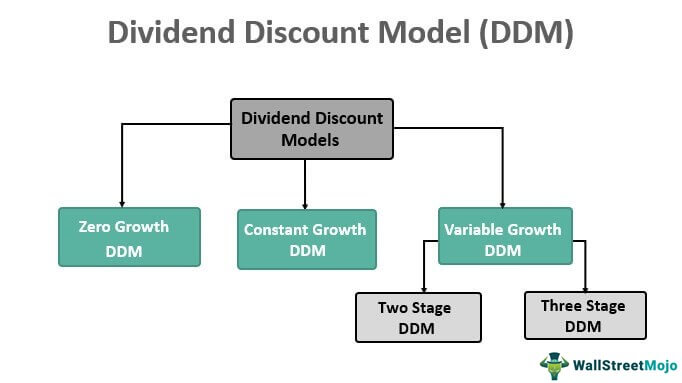

Types of Dividend Discount Models

Now that we have understood the very foundation of the dividend discount model let us move forward and learn about three types of dividend discount models.

You are free to use this image on your website, templates, etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Dividend Discount Model (DDM) (wallstreetmojo.com)

- Zero-Growth Dividend Discount Model – This model assumes that all the dividends paid by the stock remain the same forever until infinite.

- Constant Growth Dividend Discount Model – This dividend discount model assumes dividends grow at a fixed percentage. They are not variable and are consistent throughout.

- Variable Growth Dividend Discount Model or Non-Constant Growth – This model may divide the growth into two or three phases. The first one will be a fast initial phase, then a slower transition phase, and ultimately ends with a lower rate for the infinite period.

We will discuss each one in greater detail now.

#1 – Zero-growth Dividend Discount Model

The zero-growth model assumes that the dividend always stays the same, i.e., there is no growth in dividends. Therefore, the stock price would be equal to the annual dividends divided by the required rate of return.

Stock's Intrinsic Value = Annual Dividends / Required Rate of Return

It is the same formula used to calculate thepresent value of perpetuity Perpetuity can be defined as the income stream that the individual gets for an infinite time. Its present value is derived by discounting the identical cash flows with the discounting rate. Here the cash flows are endless, but its current value amounts to a limited value. read more and can be used to price preferred stock, which pays a dividend that is a specified percentage of its par value. A stock based on the zero-growth model can still change in price if the required rate changes when perceived risk changes.

Zero Growth Dividend Discount Model – Example

If a preferred share A preferred share is a share that enjoys priority in receiving dividends compared to common stock. The dividend rate can be fixed or floating depending upon the terms of the issue. Also, preferred stockholders generally do not enjoy voting rights. However, their claims are discharged before the shares of common stockholders at the time of liquidation. read more of stock pays dividends of $1.80 per year, and the required rate of return for the stock is 8%, then what is its intrinsic value?

Solution:

Here, we use the dividend discount model formula for zero growth dividends:

Dividend Discount Model Formula = Intrinsic Value = Annual Dividends / Required Rate of Return

Intrinsic Value = $1.80/0.08 = $22.50.

The shortcoming of the model above is that you would expect most companies to grow over time.

#2 – Constant-Growth Rate DDM Model

The constant-growth dividend discount model or theGordon Growth Model Gordon Growth Model is a Dividend Discount Model variant used for stock price calculation as per the Net Present Value (NPV) of its future dividends. read more assumes dividends grow by a specific percentage each year.

Using this method, can you value Google, Amazon, Facebook, and Twitter? Of course, No! As these companies do not give dividends. More importantly, they are growing at a much faster rate. Constant-growth models can value mature companies whose dividends have increased steadily.

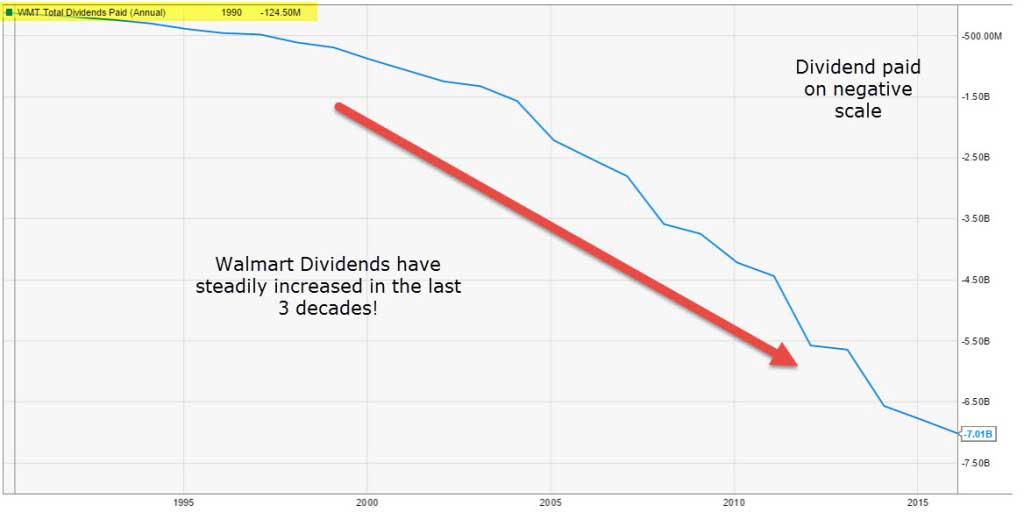

Let us look at Walmart's dividends paid in the last 30 years. Walmart is a mature company, and we note that the dividends have steadily increased. As a result, this company can be a candidate that can be valued using the constant-growth dividend discount model.

source: ycharts

Please note that in the constant-growth Dividend Discount Model, we do assume that the growth rate in dividends is constant; however, the actual dividends outgo increases each year.

Please note that we assume that the growth rate in dividends is constant ;however, the actual dividends outgo increases each year.

Dividends' growth rates are generally denoted as g, and Ke indicates the required rate. Another important assumption you should note is that the necessary rate or Ke remains constant every year.

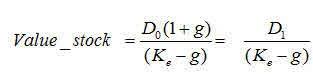

The constant-growth dividend discount model or DDM model gives us the present value of an infinite stream of dividends growing at a constant rate.

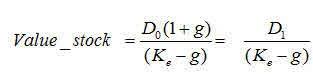

The constant-growth dividend discount model formula is as below: –

Where:

- D1 = Value of dividend to be received next year

- D0 = Value of dividend received this year

- g = Growth rate of dividend

- Ke = Discount rate

Constant-growth Dividend Discount Model- Example#1

If a stock pays a $4 dividend this year, and the dividend has been growing 6% annually, what will be the stock's intrinsic value, assuming a required rate of return of 12%?

Solution:

D1 = $4 x 1.06 = $4.24

Ke = 12%

Growth rate or g = 6%

Intrinsic stock price = $4.24 / (0.12 – 0.06) = $4/0.06 = $70.66

Constant-growth Dividend Discount Model – Example#2

If a stock sells at $315 and the current dividends are $20. What might the market assume the growth rate of dividends for this stock if the required return rate is 15%?

Solution:

In this example, we will assume that the market price is the Intrinsic Value = $315

This implies,

$315 = $20 x (1+g) / (0.15 – g)

If we solve the above equation for g, we get the implied growth rate as 8.13%

#3 – Variable-Growth Rate DDM Model (Multi-stage Dividend Discount Model)

The variable-growth rate dividend discount model or DDM Model is much closer to reality than the other two types of dividend discount models. This model solves the problems related to unsteady dividends by assuming that the company will experience different growth phases.

Variable growth rates can take different forms; you can even assume that the growth rates vary for each year. However, the most common form is one that thinks of three different rates of growth:

- An initial high rate of growth

- A transition to slower growth

- A sustainable, steady rate of growth

The constant-growth rate model is primarily extended, with each phase of growth calculated using the constant-growth method but using different growth rates for the different phases. Finally, the present values of each stage are added together to derive the stock's intrinsic value.

This can be applied as follows:

#3.1 – Two-stage DDM

This model is designed to value the equity in a firm with two stages of growth, an initial period of higher growth and a subsequent period of stable growth.

Two-stage dividend discount model is best suited for firms paying residual cash in dividends while having moderate growth. For instance, it is more reasonable to assume that a firm growing at 12% in the high growth period will see its growth rate drop to 6% afterward.

In my opinion, the companies with a higher dividend payout ratio may fit such a model. As we note below, such two companies – Coca-Cola and PepsiCo. Both companies continue to pay dividends regularly, and their dividend payout ratio is between 70%-80%. In addition, these two companies show relatively stable growth rates.

source: ycharts

Assumptions

- A higher growth rate is expected in the first period.

- This higher growth rate will drop to a stable growth rate at the end of the first period.

- Thedividend payout ratio The dividend payout ratio is the ratio between the total amount of dividends paid (preferred and normal dividend) to the company's net income. Formula = Dividends/Net Income read more is consistent with the expected growth rate.

Two-stage DDM model – Example

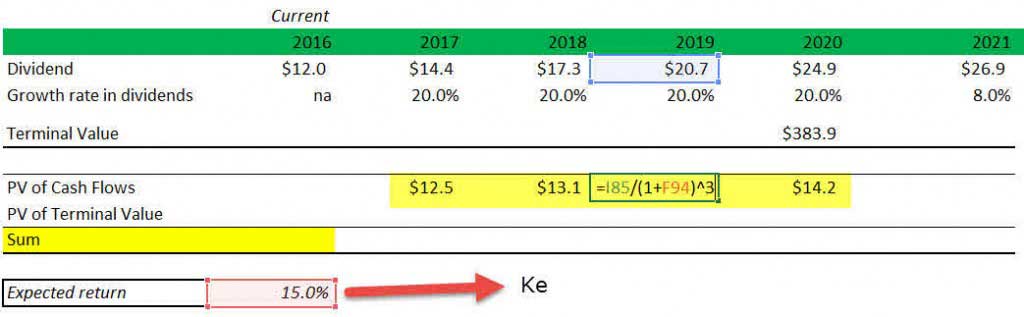

CheckMate forecasts that its dividend will grow at 20% per year for the next four years before settling down at a constant 8% forever. Dividend (current year,2016) = $12; expected rate of return = 15%. What is the value of the stock now?

Step 1: Calculate the dividends for each year till the stable growth rate is reached

The first value component is the present value of the expected dividends during the high growth period. For example, on the current dividends ($12) basis, the expected growth rate (15%) value of dividends (D1, D2, D3) can be computed for each year in the high growth period.

A stable growth rate is achieved after 4 years. Hence, we calculate the Dividend profile until 2010.

Step 2: Apply the dividend discount model to calculate the terminal value (price at the end of the high growth phase)

We can use the dividend discount model at any point in time. In this example, the dividend growth is constant for the first four years, then decreases. So, we can calculate the price that a stock should sell for in four years, i.e., the terminal value at the end of the high growth phase (2020). That can be estimated using the constant-growth dividend discount model formula: –

We apply the dividend discount model formula in Excel. As seen below, TV or terminal value at the end of 2020.

Terminal value (2020) is $383.9

Step 3: Find the present value of all the projected dividends

The present value of dividends during the high growth period (2017-2020) is given below. Please note that the required rate of return in this example is 15%.

Step 4: Find the present value of Terminal Value.

Present value of terminal value = $219.5

Step 5: Find the fair value – the PV of projected dividends and the PV of terminal value

As we already know, the stock's intrinsic value is the present value of its future cash flows. Therefore, since we have calculated the present value of dividends and the present value ofterminal value Terminal Value is the value of a project at a stage beyond which it's present value cannot be calculated. This value is the permanent value from there onwards. read more , the total of both will reflect the fair value of the stock.

Fair Value = PV(projected dividends) + PV(terminal value)

Fair Value = $273.0

We can also find out the effect of changes in the expected rate of return to the stock's fair price. As we note from the graph below, the expected return rate is extremely sensitive to the required rate of return. Therefore, one should take due care tocalculate the required rate of return Required Rate of Return (RRR), also known as Hurdle Rate, is the minimum capital amount or return that an investor expects to receive from an investment. It is determined by, Required Rate of Return = (Expected Dividend Payment/Existing Stock Price) + Dividend Growth Rate read more . The required rate of return is professionally calculated using the CAPM model.

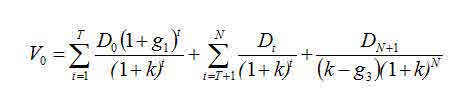

# 3.2 – Three stage Dividend Discount Model DDM

One improvement that we can make to the two-stage DDM model is to allow the growth rate to change slowly rather than instantaneously.

The three-stage dividend discount model or DDM model is given by: –

- First phase:There is a constant dividend growth (g1) or with no dividend.

- Second phase:There is a gradual dividend decline to the final level.

- Third phase: There is a constant dividend growth again (g3), i.e., the growth company opportunities are over.

One can similarly apply the logic we applied to the two-stage model to the three-stage model. Below is the dividend discount model formula for using the three-stage.

My advice would be not to be intimidated by this dividend discount model formula. Just apply the logic that we used in the two-stage dividend discount model. The only change will be one more growth rate between the high growth phase and the stable phase. It would help if you found out the respective dividends and their present values for this growth rate.

If you want to find more examples of dividend-paying stocks, you can refer to theDividend Aristocrats list. This list contains 50 stocks with a dividend-paying history of 25+years.

Advantages

- Sound Logic – The dividend discount model tries to value the stock based on the future cash flow profile. Here, the future cash flows are nothing but dividends. In addition, there is very little subjectivity in the mathematical model, and hence, many analysts show faith in this model.

- Mature Business – The regular payment of dividends does imply that the company has matured, and there may not be much volatility associated with the growth rates and earnings. That is important for investors who prefer to invest in stocks that pay regular dividends.

- Consistency – Since dividends are paid by cash in most cases, companies tend to keep their dividend payments in sync with the business fundamentals. It implies that companies may not want to manipulate dividend payments as they can directly lead to stock price volatility.

Limitations

For understanding the limitations of the dividend discount model, let us take the example of Berkshire Hathaway.

CEO Warren Buffett mentions that dividends are almost a last resort for corporate management, suggesting companies should prefer to reinvest in their businesses and seek "projects to become more efficient, expand territorially, extend and improve product lines, or to widen otherwise theeconomic moat The basic meaning of Economic Moat, as defined by Warren Buffet, is to gain a competitive advantage over competitors by developing the brand, its products, and/or services in such a way that competitors find it difficult to mimic and thus provides a long-term advantage for the company to sustain and grow in the market in comparison to competitors and rivals. read more separating the company from its competitors." By holding onto every dollar of cash possible, Berkshire has been able to reinvest it at better returns than most shareholders would have earned on their own.

Amazon, Google, Biogen are other examples that don't pay dividends and have given some amazing returns to the shareholders.

- One can only use it to value mature companies – This model efficiently values mature companies and cannot value high-growth companies like Facebook, Twitter, Amazon, etc.

- The sensitivity of assumptions – As we saw earlier, the fairprice is highly sensitive Price Sensitivity, also known and calculated by Price Elasticity of Demand, is a measure of change (in percentage term) in the demand of the product or service compared to the changes in the price. It is used widely in the business world to decide the pricing of a product or study consumer behavior. read more to growth rates and the required rate of return. So a 1% change in these two can affect the company's valuation by as much as 10%-20%.

- It may not be related to earnings – In theory, dividends should be correlated to the company's earnings. But, on the contrary, companies try to maintain a stable dividend payout instead of the variable payout based on earnings. In many cases, companies have even borrowed cash to pay dividends.

What Next?

Please comment below if you learned something new or enjoyed this dividend discount model post. Let me know what you think. Many thanks, and take care. Happy learning!

Dividend Discount Model – Foundation Video

Recommended Articles

This article has been a guide to what is the Dividend Discount Model. Here, we discuss dividend discount model types (zero-growth, constant-growth, and variable-growth – 2 stages and 3 stages), dividend model formula with practical examples, and case studies.

- Gordon Growth Model Calculation

- CAPM Beta

- Alibaba Valuation Guide

- Terminal Value Formula

sebastianhappereand.blogspot.com

Source: https://www.wallstreetmojo.com/dividend-discount-model/

0 Response to "Calculating Continuation Value in a Ddm"

Post a Comment